Reporting Standards and Frameworks

Key Takeaways

-

Knowing the sustainability reporting landscape allows organizations to appreciate the intertwined functions of standard setters, data aggregators, assurance providers, and regulators in guiding impactful disclosures.

-

Choosing the right reporting framework depends on factors including industry relevance, stakeholder demands, organizational resources, and strategic goal alignment.

-

Since major sustainability reporting standards and frameworks all have their own purpose, matching organizational goals to the right framework improves reporting quality and consistency.

-

Strong sustainability reporting not only helps with compliance but also enables risk mitigation, enhances reputation, increases operational efficiency, and offers greater access to capital.

-

With emerging trends like digitalization, interoperability, and dynamic materiality transforming sustainability reporting, organizations must stay adaptable and leverage technological advancements.

-

By addressing challenges related to data collection, internal alignment, and emerging regulations, you need clear communication, effective use of technology, and proactive leadership to make sustainability disclosures credible and valuable.

Reporting standards and frameworks provide protocols and instructions for how organizations disclose their information, activities, or effects. Many organizations employ these as a way to maintain reporting that is transparent and equitable among readers and teams.

Common options include the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and International Financial Reporting Standards (IFRS). All of them suit different requirements or domains.

To choose the best fit, understand what each standard addresses and why it’s important. Let’s get started.

The Sustainability Reporting Ecosystem

The sustainability reporting ecosystem consists of frameworks, standards, regulations, and a number of important players. These components act as an ecosystem to enable companies to disclose transparent, consistent, and relevant sustainability data.

As more global markets and stakeholders require reliable ESG data, the ecosystem is trending toward shared standards and, frequently, obligatory disclosures.

Frameworks articulate what and why to report, and standards describe how. The overwhelming majority of organizations use more than one framework or standard, reflecting the critical importance of interoperability between these tools for comprehensive coverage.

Recent rules like the EU’s CSRD underscore the transition to compulsory ESG reporting for thousands of firms. The demand for more actionable information is resulting in increased attempts to integrate standards, such as integrating TCFD recommendations into the IFRS Sustainability Disclosure Standards.

Key players in this ecosystem include:

-

Standard setters craft and update the guidelines for ESG disclosures.

-

Data aggregators collect, normalize, and distribute ESG data from various sources.

-

Assurance providers review and verify the quality of sustainability reports.

-

Regulatory bodies set, monitor, and enforce sustainability disclosure requirements.

Regulatory Bodies

|

Region |

Regulation |

Year |

Scope |

|---|---|---|---|

|

EU |

CSRD |

2024 |

Nearly 50,000 companies |

|

USA |

SEC Climate Rules |

2023 |

Public companies, climate disclosures |

|

APAC |

TCFD-based mandates |

2022 |

Listed companies (select markets) |

Regulations propel the manner in which organizations disclose sustainability information and frequently establish the baseline. Global rules such as the EU’s CSRD or the SEC’s climate rules govern how companies gather, audit, and disclose ESG data.

Regulators frequently coordinate with standard setters so that their rules are aligned and minimize confusion for organizations. This collaboration aids in creating a unified vocabulary for sustainability disclosures, simplifying the compliance process for businesses and enabling stakeholders to analyze information.

Key Reporting Standards and Frameworks

Frameworks provide high-level guidance or principles. They list the important topics (e.g. climate risk, social impact, governance processes) and outline how to structure your report. They do not give exact formulas or data definitions.

Standards, on the other hand, translate those big ideas into concrete data fields. They prescribe what must be reported, how to measure it, and often set thresholds or units. For example, the Global Reporting Initiative (GRI) framework tells you to report greenhouse gas emissions, but the GRI standards specify the exact emissions scopes and calculation methods.

Similarly, the IFRS Sustainability Disclosure Standards (S1/S2) tell companies to cover governance, strategy, risk, and metrics in line with TCFD’s climate guidance. In short, frameworks ask “What should we talk about?”, and standards answer “How do we define and calculate it?”.

Major Reporting Standards and Frameworks

There are many standards out there. Here are some of the most important ones to know:

Global Reporting Initiative (GRI)

The GRI standards are among the most widely used worldwide. They cover a broad range of ESG issues (environmental, social, and governance) and are designed for all stakeholders. GRI tells you to report on impacts like emissions, labor practices, human rights, etc. The standards even walk you through identifying “material” topics based on your impacts. Many companies use GRI alongside other frameworks to give the big-picture impact story.

Sustainability Accounting Standards Board (SASB)

Now part of the IFRS Foundation’s ISSB, SASB provides industry-specific standards focusing on financially material ESG issues for investors. There are 77 SASB industry standards, each with about 6 topics and ~13 metrics (e.g., water usage in agriculture, labor safety in energy). If your audience is mainly investors, SASB’s targeted, numbers-driven approach is a good fit.

(Note: IFRS S1 now directs companies to consider SASB topics when identifying industry-specific risks, and IFRS S2 climate metrics are actually drawn from SASB standards.)

ISSB/IFRS Sustainability Standards (S1 & S2)

In mid-2023, the new ISSB (International Sustainability Standards Board) released IFRS S1 (general ESG disclosures) and S2 (climate disclosures), effective from 2024. These are investor-focused, global baseline standards built on prior frameworks (CDSB, TCFD, Integrated Reporting, SASB). They cover the same four core areas as TCFD (governance, strategy, risk, metrics) and aim to make disclosures globally comparable.

As of mid-2025, 36 jurisdictions had announced plans to adopt IFRS S1/S2 into their reporting requirements. The IFRS standards fully integrate TCFD, so you don’t have to apply TCFD separately if you follow IFRS S2.

Task Force on Climate-related Financial Disclosures (TCFD)

TCFD is a framework specifically for climate. It lays out recommendations for disclosing governance, strategy, risk management, and metrics related to climate change. It was created to give investors clearer information on climate risk. Many companies use TCFD guidance (or the ISSB climate standard) to cover transition risks, physical impacts, and emissions in their reports.

EU Standards (CSRD/ESRS)

The EU is rolling out the Corporate Sustainability Reporting Directive (CSRD), which will require ~50,000 companies to report under the new European Sustainability Reporting Standards (ESRS). ESRS is broad: it uses a double-materiality approach (impact and financial) and covers everything from climate and energy to biodiversity and social issues.

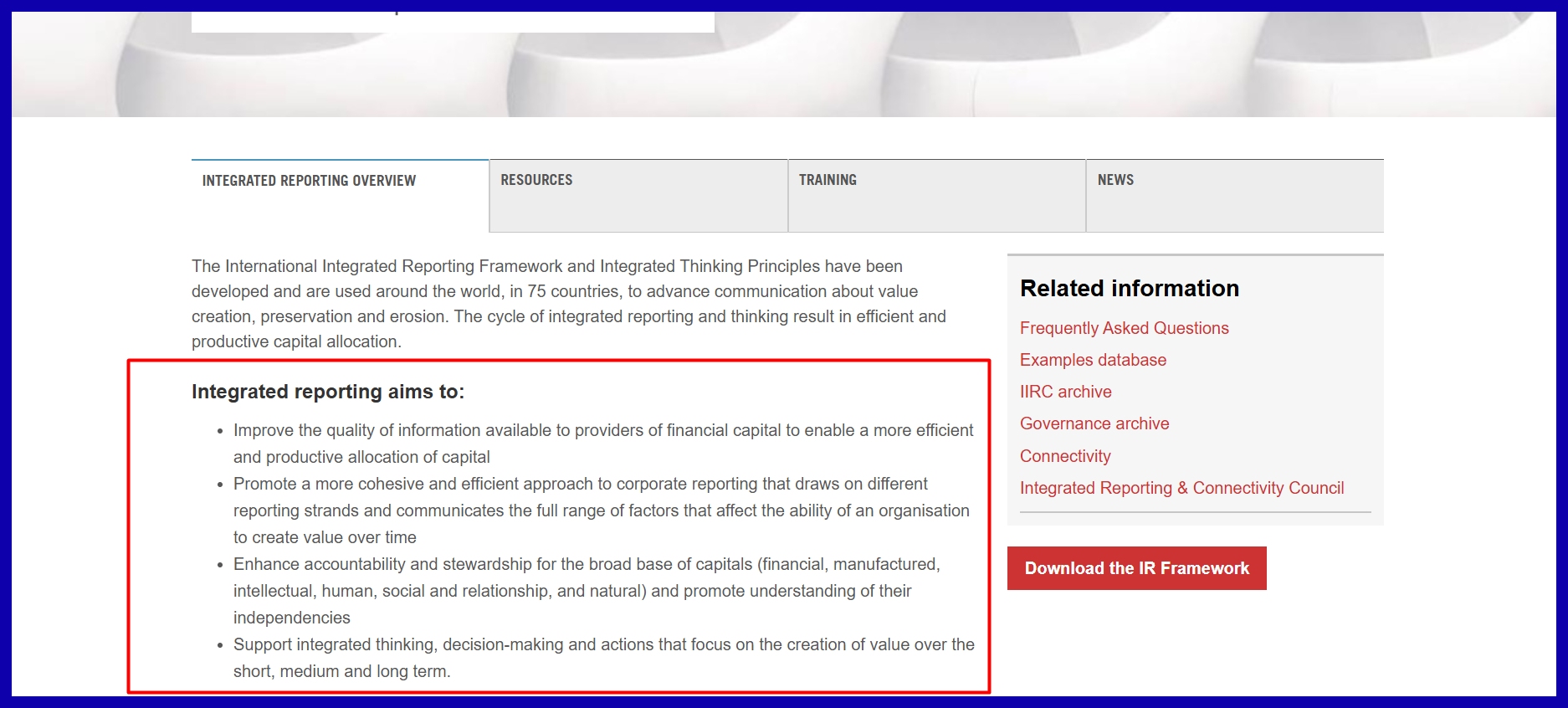

Integrated Reporting (<IR>)

More of a framework than a standard, <IR> encourages companies to present financial and sustainability info together to show how they create value. It looks at multiple types of capital (financial, environmental, social, etc.) in one concise report. While not mandatory, it’s a growing trend: leaders like Maersk now weave ESG disclosures directly into their annual reports, blending climate goals and financial performance in one integrated story.

Each of these has its niche. The main thing is to pick those that fit your company’s strategy and your stakeholders’ interests. Do investors want industry-level metrics? Use ISSB/SASB. Are communities and employees a big audience? Use GRI or SDGs. Are you in the EU? CSRD/ESRS rules might be mandatory. Often, you’ll end up following several in parallel to cover all bases.

The Future of Reporting

Reporting is undergoing rapid shifts in standards and frameworks as the world requires more transparency and trust. Global regulators, investors, and the public now expect companies to report both financial and non-financial outcomes as one narrative, not in separate documents. Integrated reporting, where financial performance sits next to sustainability metrics, is the new normal.

The ISSB is forcing firms across the globe to take a unified baseline for sustainability disclosures. This transition isn’t only about regulatory obedience. It’s about trust and decision-making.

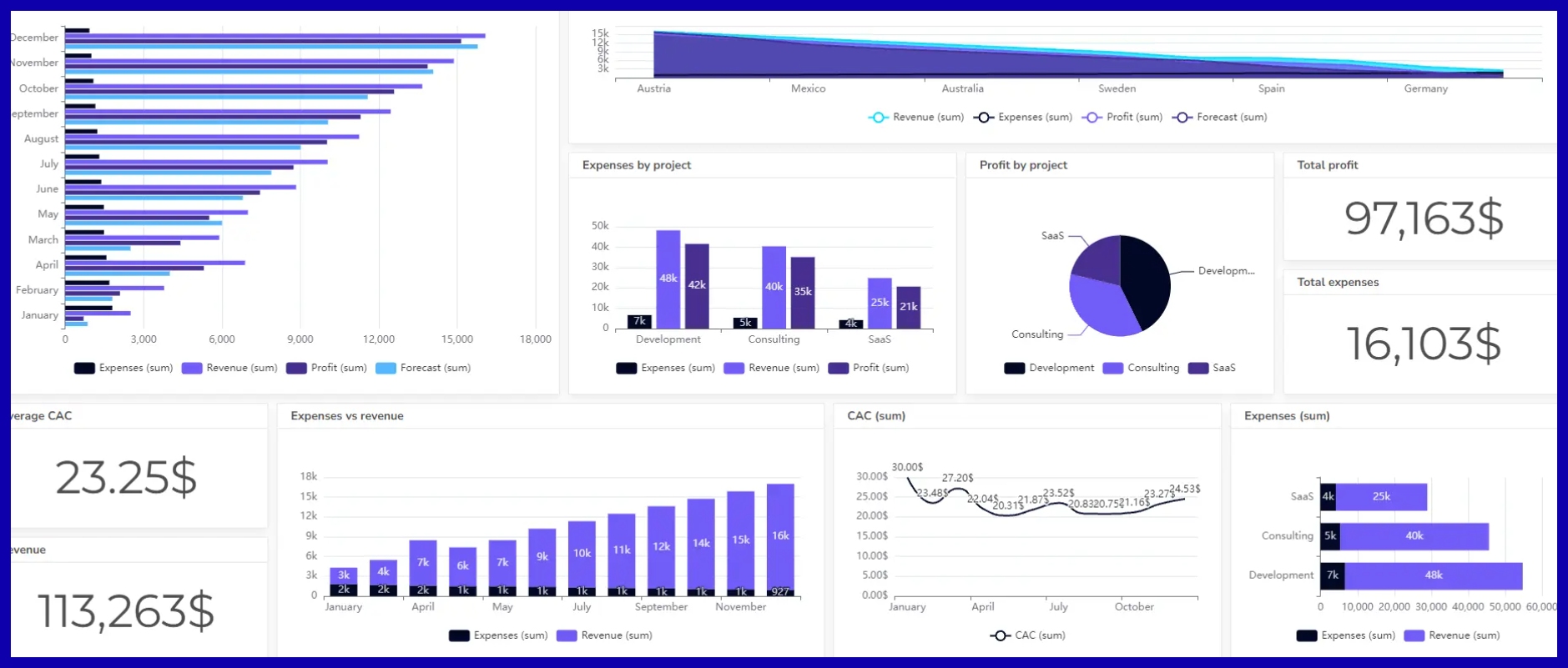

Digitalization

Reports used to be static PDFs or web pages. Now regulators and investors expect machine-readable data and real-time updates. Think of digital tags (like XBRL for financials) coming to ESG: companies will publish data that computers can instantly parse and compare.

Software platforms like KPI.me are key: modern ESG tools let you pull data from operations, HR, and finance into one place, automate calculations, and spot trends.

Artificial intelligence and analytics will further streamline data work, helping teams focus on insights rather than manual entry. In practice, this means less lag between an event (say, a factory upgrade) and its impact on your sustainability KPIs.

Conclusion

To keep up with change, reporting standards and frameworks really matter. Teams have a means to demonstrate impact, remain aligned, and gain confidence in their work. A proper fit will assist any agency or team in organizing complicated information and presenting it in a sensible way. Experience demonstrates that transparent, truthful reporting earns trust. Intelligent decision-making in the present prepares teams to address future requirements.

To keep sharp, keep learning and seek out tools that trim the fat and present your narrative neatly. Curious to check out what easy, intelligent reporting looks like? Try KPI.me and watch your data come to life without the clutter.

Frequently Asked Questions

What are the main sustainability reporting standards?

The main standards in the sustainability disclosure landscape include the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), International Sustainability Standards Board (ISSB), and Task Force on Climate-related Financial Disclosures (TCFD), which are pivotal for effective sustainability reporting frameworks.

How do reporting frameworks differ from reporting standards?

Frameworks, including major sustainability reporting frameworks, tell you how to organize and report information. Standards, such as the sustainability disclosure guidelines, set out what specifically should be reported, contributing to building consistency and transparency.

Why is it important to select the right reporting framework?

Smart framework selection means your sustainability reporting frameworks satisfy stakeholder needs, align with global expectations, and support compliance with sustainability disclosure guidelines. It enhances data comparability and credibility.

What is the strategic value of sustainability reporting?

Sustainability reporting is not only about compliance; it establishes credibility among stakeholders, facilitates informed decision-making, and enhances a business’s public image and market position through sustainability disclosure guidelines.

What are common challenges in implementing reporting standards?

Organizations often struggle with data collection and standards integration within the evolving sustainability disclosure landscape, but planning and continual training can enhance their sustainability reporting process and meet stakeholder expectations.

How is the future of reporting evolving?

Reporting is becoming more digital, transparent, and standardized, focusing on climate impact and social factors while aligning with major sustainability reporting frameworks to meet stakeholder demands.

Are sustainability reports only for large companies?

No, companies of all sizes enjoy the advantages of sustainability reporting frameworks. This process provides a means to show accountability, draw sustainable investments, and address increasing regulatory and stakeholder demands.